Since 2018, ETHDenver has been one crypto’s most consistent and energetic conferences that helps the community get a sense of what the future look like in our industry.

This year is certainly different from the excitement that was had in 2022 due to current macro financial effects and centralized crypto projects that have collapsed. Yet the conference recorded over 35K attendees in the National Western Complex and it was as full as I’ve ever seen it.

With the privilege of heading to most of the events from Monday to Saturday, here are some of the lessons and trends I learned during the week.

Incentivization strategies are key while liquidity is scarce

One theme that was constantly repeated all week was the exploration of different incentive mechanisms to bring revenue during these current market conditions.

Many projects were claiming to have interesting methods to shock their economies initially by pulling inflationary or deflationary levers to make ends meet during this down cycle. But economists really only have the ability to help on the supply side, they can’t force the market to demand crypto services, especially when the onboarding costs for some of these services outweigh the speculative rewards.

Teams who claim to bring actual utility to crypto use cases, while adding a Web3 edge appeared to be the ones beating their chest the loudest. While Liquidity Providers in crypto were not as highly advertised at the conference as in years past.

Zero-Knowledge Proofs, Multiparty Computation & Rollups dominate innovation in 2023

From the Shared Security Summit, to Zero-Knowledge (ZK)Day to the Interop Summit, zero-knowledge proofs (ZKP’s), multiparty computation (MPC) and rollups garnered the most attention from developers and investors alike.

There is a need in crypto to want to share globally, but from many in the industry they want to do this in a privacy preserving way. Projects like EigenLayer (horizontal restaking), Scroll (improving proof generations) and Axelar (private cross-chain communication tool) stood out the most for community buzz and use cases with clients behind them.

Most enterprises and institutional representatives seemed hopeful that multiparty computation (MPC) technology could allow them to stay compliant from a custody perspective while also enabling their customers to interact in decentralized economies.

One problem statement that came from people at ZK Day was that soon the crypto space may run out of hardware capacity to run all of this ZK software if it ever reaches mainstream adoption. Fabric Cryptography, was a team claiming to build zk-efficient hardware that reduces the computational burden of proofs and allow for faster transactions.

Crypto gaming continues to build interest

I was fortunate to meet many investors during VIP breakfasts and dinners and I heard as a growing theme that they were looking to deploy more capital into gaming startups. Claiming that gaming and the native use cases of playing with assets, unlocking new levels and being digitally native are some of the most enticing investment opportunities.

Tokens in games could represent ownership of assets that drive alignment between users and the network. The availability of data on-chain for games make token incentives much more powerful, because the users who are more highly engaged are those who are also using competitive products, data for which have a need for composability and transferability.

There were so many startup founders in this space that it was hard for me to pin down just one that stood out from the other.

Interoperability: a want, but not a need… yet

There are three characteristics users want in their interoperability protocols: safety, speed and low cost. As you can imagine, this trilemma is difficult to accomplish. 2022 helped the space learn some lessons in how to be safer, but blockchains by nature are never known for speed and many users have lost millions in transaction and gas costs. Projects like Gelato (gasless transactions) look make cross-chain transactions cheaper, and ZK Rollup projects like StarkNet and zkSync garnered a bit of attention on the mainstage for Thursday and Friday at the conference.

However most crypto transactions are bridged on Binance, Ronin and Avalanche, but there is a lack of interchain activity between all of them. They interact in a hub and spoke model, where most bridges interact in 1-to-1 use cases. As of today the space hasn’t reached full maturity, but as technology and understanding of these protocols grow, there may be opportunity for actual interchain activity.

Cross-chain MEV also was highlighted as an interesting investment strategy, yet Ethereum still generates more MEV than all other chain ecosystems combined.

Account Abstraction for Ethereum could help onboard users

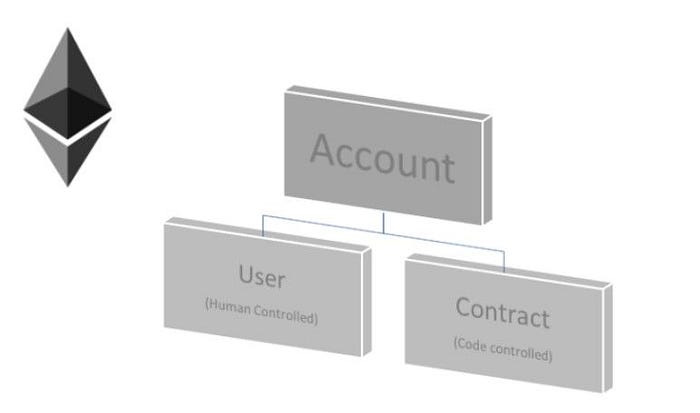

Today Ethereum has two kinds of accounts:

- Smart contracts— code created by developers

- Wallets — digital assets and currencies held by users

Account abstraction takes the responsibility of signing transactions from wallets and abstracts it away to smart contract accounts. Allowing developers to create programmable wallets. This is known as ERC-4337, which is a new standard for abstracting accounts on Ethereum and other EVM chains.

The Good:

- No more seed phrases for authentication methods in wallets

- More Web2 wallet recovery methods

- Sponsor gasless transactions across wallets

The Bad:

- Security concerns as more plain-text language manages accounts

- Additional third parties may have access to private information if you permit them

Overall it seems like a promising way to allow everyday people to sign into crypto the way they typically have on the internet, which may bring more people into the space.

Filecoin Virtual Machine (FVM) creates financialization for an open data economy

TheFilecoin Virtual Machine (FVM)allows theFilecoinecosystem to create on-chain financial services on top of decentralized data storage, which enables more sophisticated use cases in this ecosystem. Just as composability enables DeFi to create the construction of key financial markets services in a permissionless manner (e.g. automatic investment channels likeYearn, which builds on liquidity pools likeCurveand lending protocols likeCompound).

FVM is an important milestone for Filecoin, as it allows anyone to build protocols to improve the Filecoin network and build valuable services like enabling digital assets built in one protocol can be reused for other protocols.

The main use cases of the FVM will be to manage flows of data in trustless ways and to manage the flows of funds through staking, cross chain messaging and automated market makers (AMMs).

This smart contract platform launches March 14th, 2023 and it will be interesting to see how these use cases grow over time.

Conclusion

ETH Denver in 2023 grew up from years past. It didn’t feel as crowded, yet there were more people in Denver for the conference and side events than ever before. In 2022 we were shocked by some of the projects that didn’t maintain their promises, but most in the industry won’t soon forget those lessons and are building tools in this space for self-sovereignty and digitally native activities.

It was awesome to see not as many speculative projects, tokens and concepts this year and I am excited to see what the future holds for our space after this past week.

This article was made for informational purposes only. CryptoEconLab does not provide legal, tax, financial or investment advice. No party should act in reliance upon, or with the expectation of, any such advice.