Framework for Utility-Based Cryptoeconomies

Simulation & modeling results for designing value in decentralized economies

Introduction

Our team at CryptoEconLab (CEL) is excited to share our latest publication: An Agent-Based Model Framework for Utility-Based Cryptoeconomies, published and presented at the Chainscience 2023 conference.

This paper explores how Agent-Based Models (ABMs) can be adapted to a particular type of decentralized system: utility-based decentralized networks. These networks employ their own currency to provide consumptive rights on the products or services the network offers, creating a marketplace of goods providers and consumers. Since the entire system depends on the good being traded, any tool attempting to model such a system needs to consider how changes in utility impact the system and the agents.

Our approach complements other methods in the literature. It builds on the work of Zhang et al. to enable multi-scale coupling between individual microeconomic preferences and protocol-specific supply dynamics.

A Framework for Applying ABMs to Cryptoeconomies

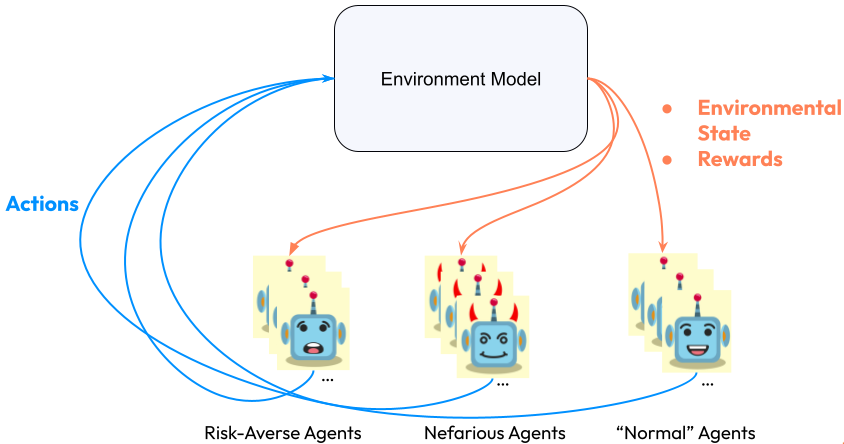

The paper begins by defining a framework for mapping cryptoeconomies to ABMs. The main components are the environment and the agents.

Three properties define the environment:

Network Performance Metrics — what are the key metrics to be modeled and used as performance indicators when evaluating the results of the ABM simulation?

Inputs — when agents take part in the cryptoeconomy, what are the subset of actions that they can take that would affect the network metrics?

Outputs — what outputs flow back to agents (i.e., miners), affecting the agent decisions about their actions in the next timestep?

The agents interacting in the defined environment are miners in a blockchain who take actions based on the environmental outputs. The environment then processes those actions, updates metrics, and generates observable outputs. The outputs are fed back to the agents, and the process is repeated. This feedback loop defines the evolution of the environment and maps well to the real world, where interactions between miners and the blockchain define the evolution of the blockchain. Figure 1 maps the flow of information between the environment and the agents.

Filecoin Example

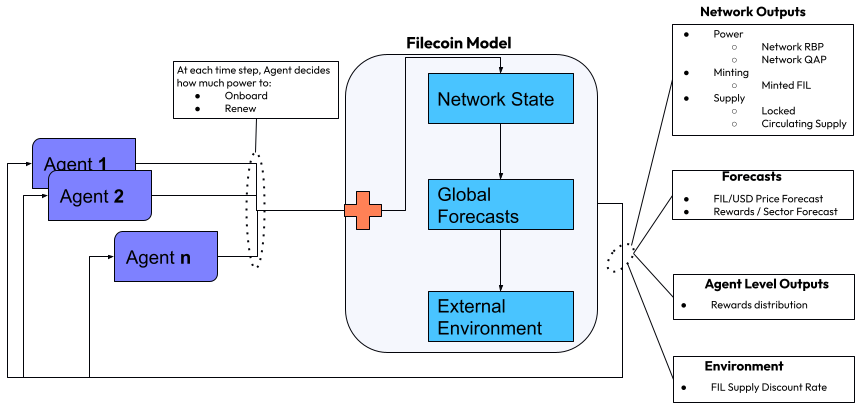

Next, the paper applies this proposed framework to Filecoin. A mathematical model is developed describing the relationship between network inputs and supply. Then, the framework described above is applied. The environment is mapped as follows:

Network Performance Metrics — three categories are relevant to Filecoin:

- Power: Network QAP, Network RBP

- Minting: Mined FIL

- Supply: Circulating Supply, LockedInputs — The amount of aggregate power onboarded and renewed on the network.

Outputs — In our model, agents can use all of the network performance metrics to make future decisions about onboarding and renewals. This maps to reality because these metrics are publically available through data aggregators such as Starboard.

Finally, agents model Storage Providers (SPs) and decide whether to onboard and/or renew power based on the environment observables.

The Filecoin ABM is shown in Figure 2.

We implement this model and use it to conduct some interesting experiments that explore the impact of certain policies on the evolution of the cryptoeconomy.

Conclusion

This work came together due to collaboration between the entire CryptoEconLab team on various aspects of cryptoeconomic modeling. The approach taken here is guided by our experience modeling cryptoeconomies for many protocols and teams. For more details, please view the paper here, or watch this talk we gave on modeling cryptoeconomies with ABMs at CryptEconDay in Austin.

This article was made for informational purposes only. CryptoEconLab does not provide legal, tax, financial, or investment advice. No party should act in reliance upon, or with the expectation of, any such advice.